For many years, PWL has published a report on Financial Planning Assumptions, which includes our estimates for asset class expected returns. This report is designed to help advisors guide their clients when making long-term financial planning projections.

We often get asked two fundamental questions about these estimated expected returns: What should we expect going forward, and why are these estimates reasonable? This article answers both questions.

We review PWL’s most recent expected returns per asset class. We focus on real returns, indicating how quickly investors can increase their inflation-adjusted wealth. These numbers guide how much investors must save in their accumulation phase to achieve their financial objectives and at what pace retirees can withdraw from their portfolios. Our time horizon is 30 years, and we assume that investors hold a widely diversified portfolio of stocks and bonds with the stated goal of providing money for future consumption. Management fees and other investment costs are not deducted from our estimates.

Table 1 provides real expected return estimates from both PWL and other sources. These sources base their estimates on assumptions that differ from PWL’s, outlined in the appendix. While these differences are significant, we believe the comparison remains informative.

| PWL | FP Canada | BlackRock | AQR Capital Management | Vanguard | |

| Canadian Bonds | 1.7% | 1.3% | 1.2% | NA | NA |

| Canadian Equity | 4.8% | 4.3% | 2.5% | NA | NA |

| US Equity | 4.2% | NA | 3.2% | 3.8% | 3.2% |

| International Equity | 5.2% | NA | 4.6% | 4.4% | 6.1% |

| Global Equity | 4.6% | 4.6% | 3.7% | 4.2% | 4.5% |

“International Equity” includes all developed and emerging markets, excluding Canada and the US.

“Global Equity” includes all developed and emerging markets.

The Global Equity expected return estimate for FP Canada is derived from a weighted average of the expected returns of the global developed and emerging markets.

Sources: PWL Capital, FP Canada, BlackRock, AQR, Vanguard, and Ken French

PWL’s expected return estimates are higher than those of peer firms for most asset classes. Our estimate is higher for Canadian bonds by 0.4% to 0.5%. Our estimates are also above our peers for Canadian and US equity, and our estimate for international equity is in the middle of the pack. Finally, our estimate for global equity is close to those of FP Canada and Vanguard. AQR and BlackRock are less optimistic, with expected returns of 4.2% and 3.7%, respectively.

Expected returns have a large margin of error, even over a 30-year horizon. The Dimson, Marsh and Staunton (DMS) data shows that 30-year real returns on global equity have a 1.7% standard deviation since 1900. In other words, under the most likely scenarios, global equity will return between 2.8% and 6.2% over 30 years. However, under extreme (unlikely but possible) scenarios, returns could be less than 1% or above 8%.

Table 2 shows PWL’s expected real return estimates compared with the historical returns for the last 30 years. Except for international equity, expected returns are broadly lower than the historical numbers. Lower expected returns on bonds are justified by the decline in the Canadian bond market yield, from roughly 6% in early 1994 to 4% currently. While the Cyclically Adjusted Price-to-Earnings (CAPE) ratio of Canadian equity is the same as 30 years ago at 22, the US CAPE has expanded from 23 to 34, Europe’s CAPE has increased moderately from 19 to 21, and Japan’s CAPE has plunged from 39 to 25 (Source: Barclays). Overall, bond yields are much lower than in 1994, and global stocks (driven mainly by US stocks) are more expensive than 30 years ago. Therefore, investors should expect lower returns in the future.

| PWL Expected Return

2024–2053 |

Historical Return

1994–2023 |

Expected Minus Historical Return | |

| Canadian Bonds | 1.7% | 3.1% | -1.4% |

| Canadian Equity | 4.8% | 6.0% | -1.2% |

| US Equity | 4.2% | 8.0% | -3.8% |

| International Equity | 5.2% | 3.5% | +1.7% |

| Global Equity | 4.6% | 5.7% | -1.2% |

Sources: DFA Web, Statistics Canada

Table 3 It summarizes PWL’s real expected returns since publishing estimates ten years ago. First, we observe a steep drop in the expected return of Canadian bonds from 2019 to 2021, followed by a rebound in 2024. This behaviour corresponds to the collapse of bond yields during the COVID-19 crisis and their subsequent comeback when central banks increased interest rates to suppress resurging inflation.

Equally important, our expected return for global equity has declined substantially since 2014, from 5.2% to 4.5%. Changes in methodology mainly explain this lower estimate, although higher stock prices probably play a secondary role.

| 2014 | 2016 | 2019 | 2021 | 2024 | |

| Canadian Bonds | 1.7% | 1.5% | 1.5% | 0.2% | 1.7% |

| Canadian Equity | 5.4% | 4.9% | 4.8% | 4.2% | 4.8% |

| US Equity | 4.6% | 4.5% | 4.2% | 4.0% | 4.2% |

| International Equity | 5.5% | 5.4% | 5.1% | 4.7% | 5.2% |

| Global Equity | 5.2% | 5.2% | 4.9% | 4.3% | 4.6% |

NB: PWL started to include emerging markets in its expected return estimate for international equity only in 2021.

Source: PWL Capital

Table 4 illustrates PWL’s real expected returns and compound values for the most common asset mixes of global stocks and Canadian bonds. Increasing a portfolio equity weight by 20% enhances its expected return by 0.5% to 0.6%. Depending on the asset mix, a dollar invested over 30 years could more than double ($2.36) to almost quadruple ($3.85) its real purchasing power. This assumes that the investor holds asset allocation constant and does not trade actively, which is proven to negatively impact returns.

| Asset Mix (Equity/Bond) | Type of Portfolio | Expected Return | Real Value of $1 Invested over 30 Years |

| 40/60 | Conservative | 2.9% | $2.36 |

| 60/40 | Balanced | 3.5% | $2.81 |

| 80/20 | Aggressive | 4.0% | $3.24 |

| 100/0 | Very Aggressive | 4.6% | $3.85 |

Source: PWL Capital

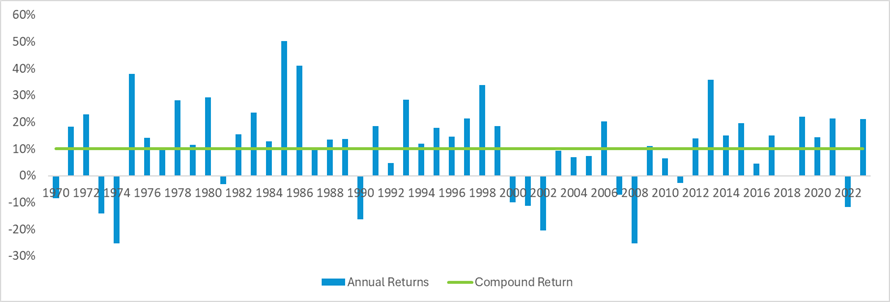

Several factors explain why investors often perceive expected equity returns to be higher than they really are. Let’s take as an example the performance of the Global Equity Index returns calculated in Canadian dollars from 1970 to 2023 (Source: DFA).

First, compound returns are always lower than average returns. The index returned an average of 11.3% per annum for the period, but the compound return was only 10.1%. This is because negative annual returns affect wealth more than positive returns. Compound returns matter most to investors since they reflect the compounding of wealth.

Second, investors don’t consume nominal returns; they consume real returns. Because the purchasing power of a dollar declines over time, nominal returns vastly overstate the value created by the index. From 1970 to 2023, inflation was 3.9%, so the real compound return of the global equity index is only 6.2% (10.1% – 3.9% = 6.2%).

Third, annual returns are volatile. The bars in Figure 1 below represent the yearly returns of the global equity index, while the straight line represents the 54-year compound return. Notice that annual returns are often far from the long-term outcome, making it challenging to estimate the long-term return.

Fourth, returns have been relatively high in the last 54 years, with a real return of 6.2% for global equity, significantly higher than the 5.2% since 1900 reported by Dimson, Marsh and Staunton.

Finally, media attention is riveted on the recent high-performing US market. Most other equity markets have delivered lower returns. We must be careful about basing return expectations on the most successful markets. This would not produce realistic return assumptions because future global market returns are driven by combining all country markets, including those underperforming.

In my opinion, future returns will likely be modest. Most investors should expect real long-term returns hovering between 3% and 4%, depending on their asset mix, before fees and taxes.

PWL is not pessimistic. Our expected return estimates are higher than those published by other credible organizations. There are good reasons to believe that future returns will be lower than in the past. That said, even with modest returns, the effect of long-term compounding will work as intended. Over thirty years, investment returns allow disciplined investors to multiply the purchasing power of their capital by a factor of two or three, again depending on the investor’s asset mix, discipline and cost control.

Fees matter. A classic 60% equity/40% bond portfolio has a 3.5% pre-fee real expected return. The typical 2%+ charged by mutual fund firms eats more than half of your real return. In theory, active managers more than compensate for these fees with market outperformance; in practice, they fail to outperform, and in most instances, high fees only subtract from investor returns.

Finally, expected returns are not predictions. We acknowledge a substantial margin of error in our estimates. Revising your financial plan regularly and adjusting your saving or withdrawal strategy in light of unexpectedly high or low realized returns is paramount.

AQR – 2023 Capital Market Assumptions for Major Asset Classes

BlackRock – Capital Market Assumptions

FP Canada – Projection Assumption Guidelines

PWL Capital – Financial Planning Assumptions Data Update (Market Capitalization Weighted Portfolio)

Vanguard economic and market outlook for 2024: A return to sound money

| Date of Assessment | Time Horizon | Currency | Expected Inflation | |

| PWL | 06/30/2024 | 30 years | CAD | 2.5% |

| FP Canada | 12/31/2023 | 10 years + | CAD | 2.1% |

| BlackRock | 03/03/2024 | 20 years | CAD | 2.7% (5 years) |

| AQR Capital | 12/31/2023 | 5 to 10 years | USD | NA |

| Vanguard | 11/30/2023 | 10 years | USD | 2% |

Sources: PWL Capital, FP Canada, BlackRock, Vanguard, AQR