Investors looking to capture the returns of the US stock market can choose from various index funds. The two most popular approaches are ETFs that track a total market index, such as the CRSP US Total Market Index, and funds that track the S&P 500 Index. This paper discusses the mechanics and historical performance of both options over more than six decades.

Several index providers are backing US total market ETFs and mutual funds. The largest fund in the world—the Vanguard Total Stock Market Index Fund with $1.3 trillion in assets —has chosen the CRSP US Total Market Index as a benchmark to construct and manage its portfolio. “CRSP” stands for “Center for Research in Security Prices” and is an affiliate of the University of Chicago Booth School of Business.

While not familiar to the general public, CRSP is one of the most rigorous research organizations in finance. The CRSP US Total Market Index holds over 3,800 US stocks, weighted by free float-adjusted capitalization. Its methodology is rules-based, and there is little human intervention in inclusion, deletion, rebalancing, and weighting decisions. One key advantage of this index is that it has more history than commercial indexes, such as the Russell 3000 Index (the CRSP data series starts in 1926 compared to only 1979 for the Russell Index). The correlation between the CRSP US Total Market Index and the Russell 3000 Index from 1979 to 2023 is 0.998 (almost perfect).

Launched in March 1957, the S&P 500 Index is the most popular benchmark for US large-cap stocks. As of the end of 2021, over $7 trillion in index funds adhered to the S&P 500, while another $8 trillion in actively managed funds used this index as a benchmark for performance evaluation purposes.[i] The S&P 500 Index holds 500 US stocks, weighted on a free float-adjusted capitalization base, representing approximately 80% of the US market value. Its stock selection follows a two-step process. Eligibility for inclusion is first established based on objective criteria, such as domicile, exchange listing, market capitalization, organizational structure and share type, liquidity, and financial viability.[ii] Then, based on the list of eligible stocks, the index committee selects 500 securities deemed most representative of the US large-cap stock market. This committee-based step makes the S&P 500 Index similar to an actively managed index

We have computed the returns of the CRSP US Total Market Index and the S&P 500 Index (in USD) for the whole existence of the S&P 500 from March 1957 to June 2023. The former outperformed the latter by a mere 0.03%, as displayed in Table 1. However, the S&P 500 Index has a modestly lower volatility (14.77% vs. 15.21%) and a slightly higher Sharpe Ratio (a measure of risk-adjusted returns) (0.45 vs. 0.44). The lower volatility of the S&P 500 is explained by large-cap stocks being less volatile than small-cap stocks.

| Index | Return | Volatility | Sharpe Ratio |

| CRSP US Total Market | 10.48% | 15.21% | 0.44 |

| S&P 500 | 10.45% | 14.77% | 0.45 |

| Difference | 0.03% | 0.44% | -0.01 |

Source: PWL Capital; Data source: DFA

We have also considered the possibility that the difference in volatility could be explained by the S&P 500 “financial viability” inclusion criterion. To test this assumption, we compared the relative volatility of the S&P 500 Index and the MSCI Large Cap Index (which does not use financial viability in its selection process) for their common data availability period (January 1992 to June 2023). The difference was minimal at only 0.10%. Thus, we reject the S&P 500’s inclusion criteria as an explanation for the difference in volatility.

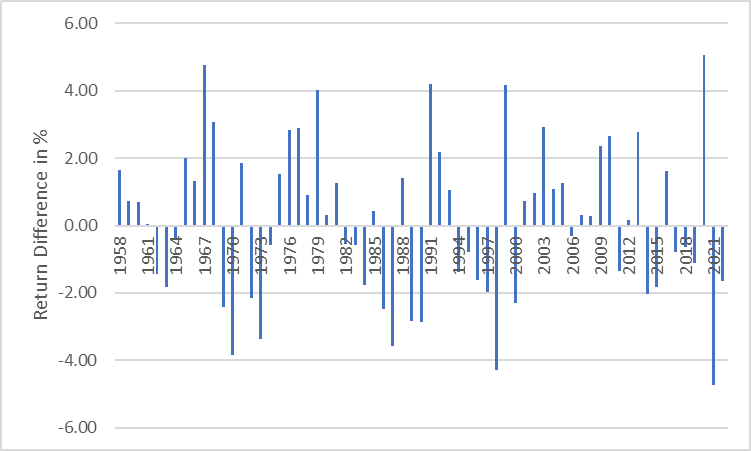

We have also analyzed the performance of both indexes for calendar years from 1958 to 2022. The CRSP US Total Market Index outperformed in 35 years, compared to 30 years for the S&P 500. The largest annual outperformance was 5.05% for the CRSP Index and 4.73% for the S&P 500 Index. Figure 1 displays yearly return differences between the two indexes.

Source: PWL Capital; Data source: DFA

Our last analysis reviews the relative returns of the two indexes during all decades since the launch of the S&P 500 Index. As one can see in Table 2, return differences were minor over ten-year periods.

| Period | CRSP US Total Market | S&P 500 | CRSP – S&P 500 |

| 1960-1969 | 8.28% | 7.81% | 0.48% |

| 1970-1979 | 6.06% | 5.87% | 0.19% |

| 1980-1989 | 16.71% | 17.55% | -0.85% |

| 1990-1999 | 18.02% | 18.21% | -0.19% |

| 2000-2009 | -0.33% | -0.95% | 0.62% |

| 2010-2019 | 13.43% | 13.56% | -0.13% |

Source: PWL Capital; Data source: DFA

The previous analysis considered pre-tax returns for indexes, while live funds have withholding tax, income tax, and fee considerations. We use the Vanguard US Total Market Index ETF (VUN) and the Vanguard S&P 500 Index ETF (VFV) as our proxies to evaluate the relative tax and cost efficiency of the US Total Market Index and an S&P 500. First, we look at dividend yields. Since foreign dividends are taxed at a very disadvantageous rate in Canada, we assume that the lower the dividend yield, the better it is from a tax perspective. Over the last two years, VUN and VFV had very similar dividend yields on average, at 1.49% and 1.51% respectively.

Next, we look at capital gain distributions, which are also detrimental to taxable accounts. As shown in Table 3, the shareholders of both ETFs were attributed capital gain distributions of 0.2% or less every year since 2013. Thus, the US Total Market and the S&P 500 indexes appear tax efficient, as most returns are earned as unrealized capital gains.

| VUN (Total Market Index) | VFV (S&P 500 Index) | |

| 2013 | 0.1% | 0.1% |

| 2014 | 0.1% | 0.0% |

| 2015 | 0.1% | 0.1% |

| 2016 | 0.1% | 0.1% |

| 2017 | 0.1% | 0.1% |

| 2018 | 0.2% | 0.0% |

| 2019 | 0.0% | 0.0% |

| 2020 | 0.0% | 0.0% |

| 2021 | 0.0% | 0.0% |

| 2022 | 0.2% | 0.0% |

Source: PWL Capital; Data source: Vanguard Canada

A final thing to consider is fees; here, VFV (0.09%) has the advantage over VUN (0.17%).

Comparing the CRSP US Total Market Index and the S&P 500 Index since 1957 reveals that their long-term returns are similar, and their representative ETFs are tax efficient. Significant differences in annual returns occur frequently, but these differences are offset over extended periods. The Vanguard S&P 500 Index ETF (VFV) offers a few advantages: its underlying index is modestly less volatile, and its MER is lower. However, the Vanguard US Total Market Index ETF (VUN) is more diversified and benefits from a truly objective and consistent methodology.

On balance, we favour total market index funds like VUN because they always hold every liquid stock on the market, including the best-performing ones. The risk of missing out on the high return stocks was highlighted in 2020 when the S&P 500 Index committee failed to include Tesla’s shares in the index until December after the share’s price had increased by 400%. Furthermore, groundbreaking research by the University of Arizona demonstrates that, at the margin, a small number of winning stocks explains the long-term market performance; thus, we prefer not to risk missing out on these stocks. However, we believe both total market index funds and the S&P 500 index funds are preferable to traditional active management for long-term investors.

[i] Source: Morningstar. In US dollars.

[ii] Source: S&P Dow Jones Global Indices

[iii] S&P Dow Jones Global Indices’ definition of “financial viability”: “The sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (GAAP) earnings (net income excluding discontinued operations) should be positive as should the most recent quarter.”