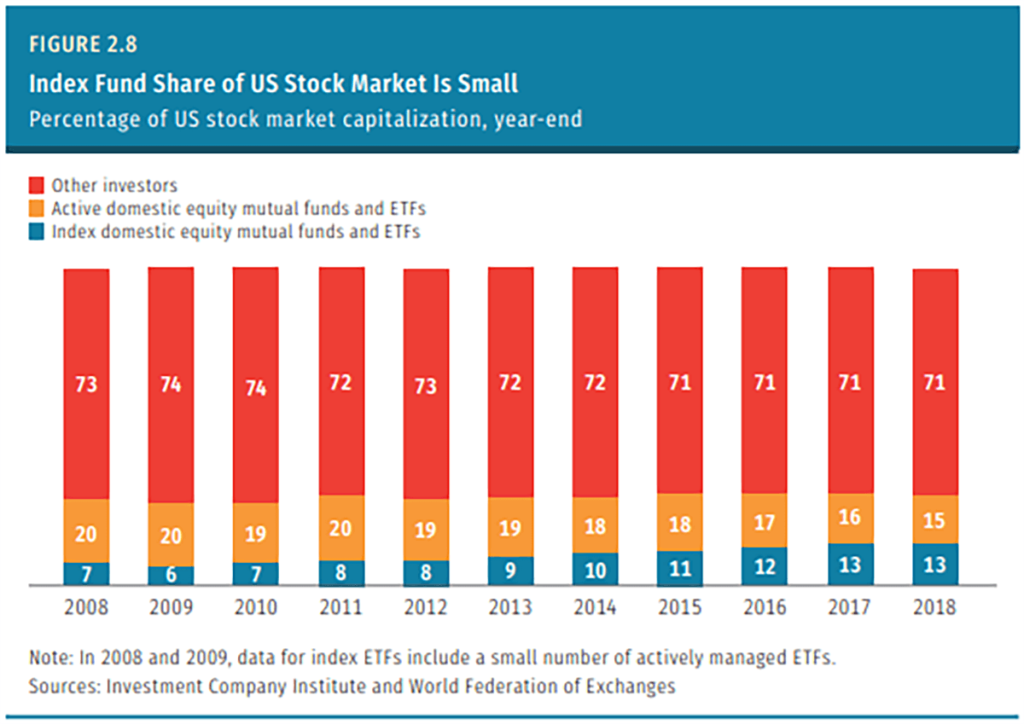

Welcome back to your weekly reality check on sensible investing and financial decision making for Canadians. On today’s episode we kick it off with a combo of a current topics, answering listener questions, and discussing the bad advice of the week. We then dive into the huge shift in the industry in the US in terms of fund flows into index funds out of active mutual funds. When you look at the overall US market cap, 13% of it is in index funds. This means that price discovery is being done by 87%. Inside this episode we unpack what that means for investments overall and how it differs in the Canadian market. We then take to a deeper discussion on our portfolio management topic of the week, which is looking at the relationship between price and future returns. We know that when prices are high, future returns tend to be low, so we dive into how that affects the context of pricing. We also take a look at the AQR study, Vanguard’s dollar cost averaging versus lump sump study, and of course our planning topic for the week; renting versus buying a home and understanding the unrecoverable costs. Join us today and be sure not to miss out on today’s incredible episode!

Key Points From This Episode:

Tweetables:

“Total return is the only thing that matters to an investor.” — @benjaminwfelix [0:06:13]

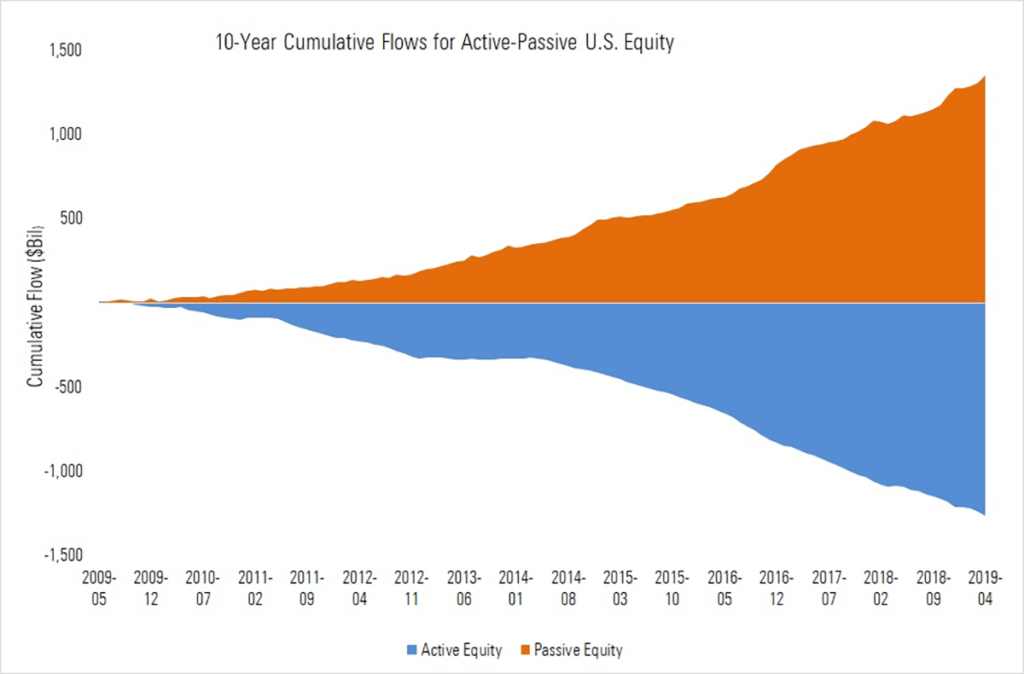

“Since 2009, so just after the global financial crisis, $1.5 trillion of funds has gone from active over to passive.” — @CameronPassmore [0:13:03]

“5% of the market’s trading activity is done by index funds.” — @CameronPassmore [0:15:00]

Links From Today’s Episode:

Rational Reminder Website — https://rationalreminder.ca/

Morningstar’s Fund Flow Commentary — https://www.morningstar.com/lp/fund-flows-direct

Investment Company Institute — https://ici.org

The Grossman-Stiglitz Paradox (feat. The Plain Bagel) — https://www.youtube.com/watch?v=zoXMZxe8crI

Larry Swedroe article — https://buckinghamadvisor.com/cape-10-ratio-in-need-of-context/

Renting vs. Buying a Home: The 5% Rule — https://www.youtube.com/watch?v=Uwl3-jBNEd4

Tim Ferriss — https://tim.blog/

Download the transcript of this episode: The Rational Reminder Podcast Ep.48 – Transcript