For the 2018/2019 school year, average tuition costs and additional compulsory fees for Canadian undergraduate students were $7,741. Ontario had the highest fees with an average of $9,771 for the school year. According to a Macleans piece, that only covers 34% of average school costs. The other $13,000 or so is eaten up by living expenses. That begs the question, will savings in an RESP be sufficient to cover education costs in Canada?

RESP accounts allow a maximum lifetime contribution of $50,000 per beneficiary. The maximum government education savings grant will add another $7,200. Grant rates and lifetime contribution limits were raised in 2007. Since then, no changes have been made to the limits while education costs across Canada have risen by 3.7% per year. Ontario’s increase was higher than Canada, at a rate of 4.25%. Using these numbers, someone who was born in 2020 might pay $63,750 on school fees alone for a four-year degree by the time they go to school. Adding a lower end of $10,000 in today’s dollars for annual living expenses, indexed at an inflation rate of 1.7% adds another $56,000 to the tuition totals.

Ultimately, how much money you have available in the RESP when the student goes to school depends on how much you contribute and how you invest the funds. I’ve looked at a variety of asset allocations with different investment returns to see how RESPs stack up compared to expected tuition costs under two savings scenarios.

Some parents want to invest conservatively in their RESP’s. They figure they’re already getting a 20% return on their money through the government grants, so why risk it. Others are comfortable being very aggressive and want to maximize the amounts available in their child’s education fund. Most are in between.

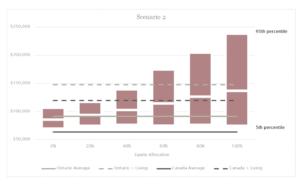

Investing in anything involves volatility. Even if you’re choosing all GIC’s in the account, most institutions don’t offer many choices beyond 5-year GIC’s, so rates can and will change throughout the 20+ years you’re investing in the RESP. To incorporate this, I’ve included the expected volatility for each portfolio and ran several scenarios outlining the median result, the 5th percentile and the 95th percentile.

In this scenario, a parent would add $2,500 every year to get the 20% or $500 grant. The grants are maxed out at $36,000 in contributions or after 14.4 years.

This scenario maximizes the allowable $50,000 contribution limit while still maximizing the government grants.

As you can see, a 100% equity portfolio will offer the highest expected portfolio value after 20 years. This makes sense because it has a higher expected return. However, you need to be comfortable with the volatility associated with such a portfolio and be able to stick it out. For example, during the financial crisis, this type of portfolio would have lost a third of its value in one year. This example also assumes a time horizon of 20 years. Adjusting that time horizon could very easily impact the ranges between the 5th and 95th percentiles.

In most scenarios, your child will need additional funds to cover university costs, especially if they don’t live at home. This can be done through other investments, cash flow, student loans, and scholarships as outlined here.

For the 2018/2019 school year, average tuition costs and additional compulsory fees for Canadian undergraduate students were $7,741. Ontario had the highest fees with an average of $9,771 for the school year. According to a Macleans piece, that only covers 34% of average school costs. The other $13,000 or so is eaten up by living expenses. That begs the question, will savings in an RESP be sufficient to cover education costs in Canada?