In our past few blogs/videos, we explored the developed international equity landscape. Now let’s take on emerging markets and their equity ETFs.

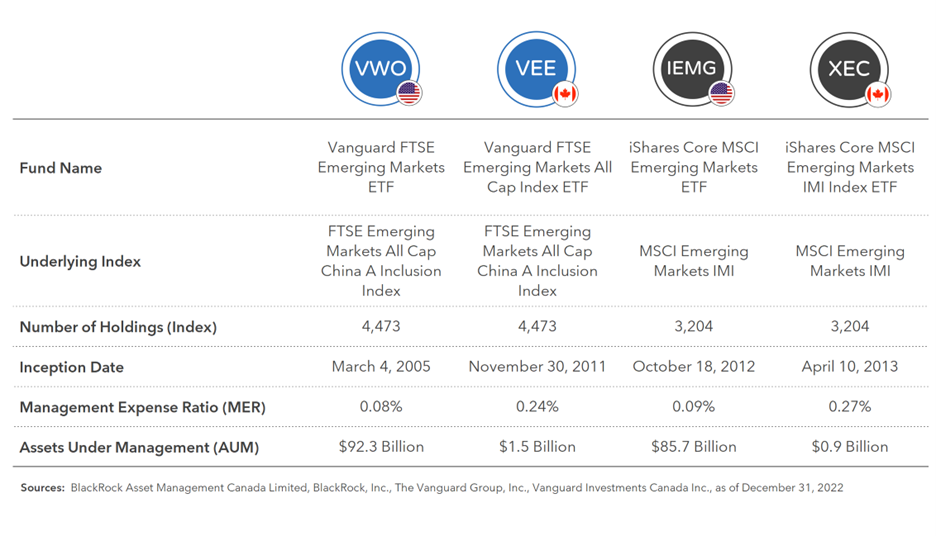

Using the ETFs found in the Vanguard and iShares asset allocation funds (along with their Canadian or U.S.-listed counterparts), we’ll discuss four representative solutions in this blog/video:

As before, I’ve marked each fund’s icon with a small Canadian or U.S. insignia, to indicate whether the ETF trades on Canadian or U.S. stock exchanges.

Like the other ETFs we’ve covered, these emerging markets equity funds have been around for many years. VWO launched first in 2005. The remaining three launched in rapid succession in 2011, 2012, and 2013.

Similar to our other equity regions, the U.S.-listed emerging markets equity ETFs, VWO and IEMG, have noticeably lower costs than VEE or XEC, which trade on the Canadian stock exchanges. All else equal, their lower MERs should help VWO and IEMG track their indexes more closely than VEE or XEC can track theirs.

Our U.S.-listed ETFs have also attracted a lot more assets than either of our Canadian-listed funds. However, since VEE and XEC achieve their emerging markets equity exposure by simply holding their VWO and IEMG U.S.-listed counterparts, their smaller scale shouldn’t create a trading disadvantage for either of them.

For the underlying indexes, VWO and VEE both track the FTSE Emerging Markets All Cap China A Inclusion Index. IEMG and XEC each track the MSCI Emerging Market IMI, or “Investable Market Index”.

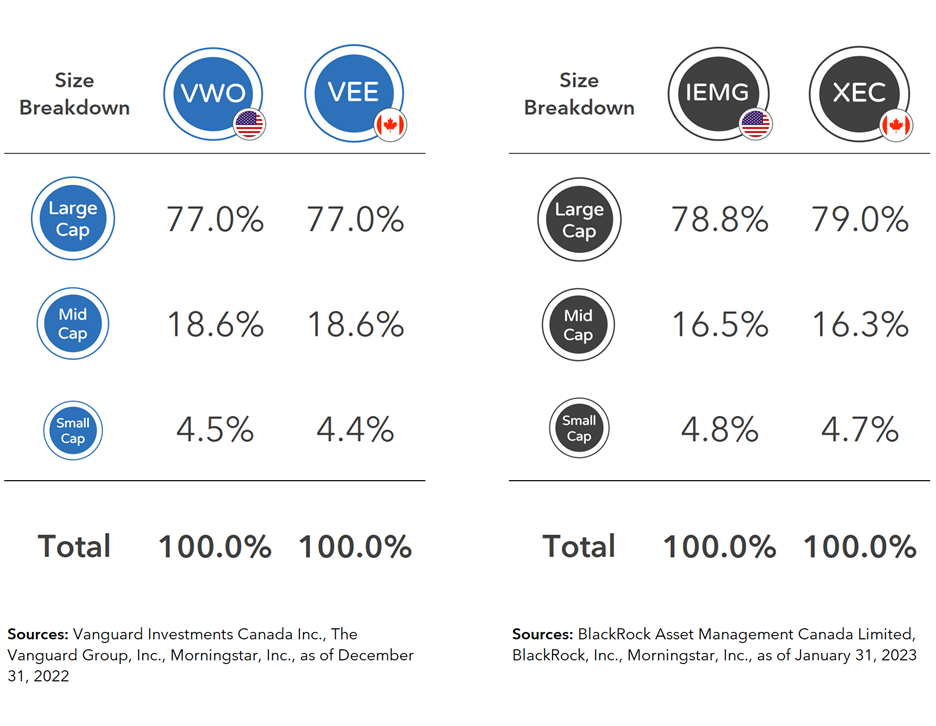

As mentioned in our international equity video, the terms “All Cap” and “IMI” are specific to the index providers. They indicate these indexes track the performance of large-, mid- and small-cap companies. In other words, they are all “broad stock market indexes”.

And like all equity ETFs tracking broad market capitalization-weighted indexes, large and mid-size companies dominate the fund’s weightings, with smaller companies making up the remainder. Since these broad stock market ETFs do not specifically target micro-cap companies, the funds give essentially no weight to them.

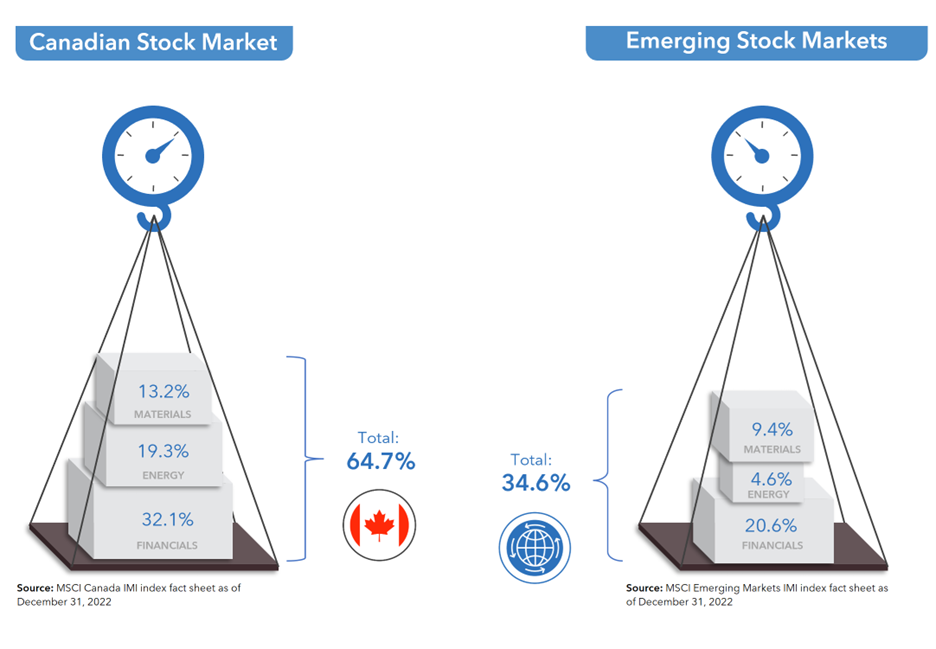

There’s one more similarity these emerging markets equity ETFs share with other foreign equity ETFs. Once again, compared to the Canadian stock market, they are less concentrated in the financials, energy, and materials sectors. So, they too provide extra sector diversification for us Canadians.

The emerging markets indexes followed by these ETFs also include thousands of individual companies, providing additional global diversification for investors of all types.

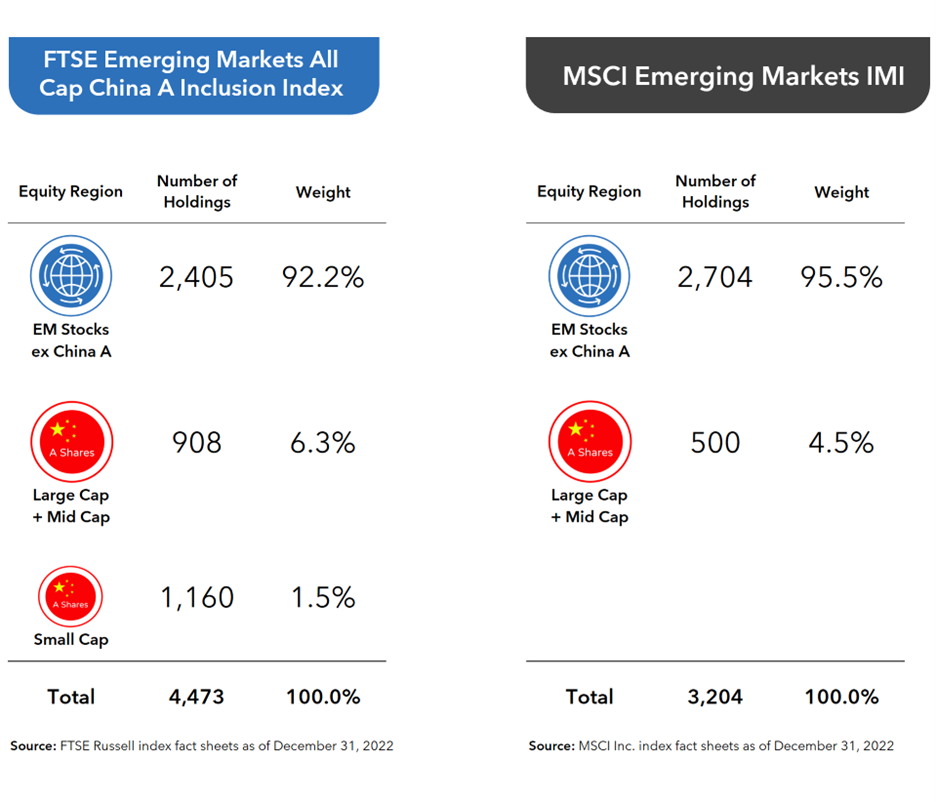

You may notice that the FTSE index tracked by VWO and VEE includes more companies than the MSCI index followed by IEMG and XEC. Most of this difference can be explained by the China A shares included in each index. These A shares trade on the China mainland, are denominated in Renminbi, and make up around half of China’s investable stock market.

Although FTSE and MSCI both include China A share allocations in their emerging markets indexes, they manage them in a slightly different way. The FTSE emerging markets indexes include large-, mid-, and small-cap China A shares, while the MSCI indexes include only large- and mid-cap China A shares.

So, yes, it’s true that adding small-cap stocks to a market cap-weighted index increases its number of holdings.

But you can probably already guess how these market-cap weightings actually work: Because each small-cap company is such a lightweight in the index, they don’t contribute noticeably to its overall diversification. The same is true of the small-cap China A shares tracked by FTSE’s emerging markets equity index. Even though their inclusion increases the index’s number of holdings, small-cap China A shares end up representing such a tiny portion of the FTSE index, they would not be expected to materially impact its returns.

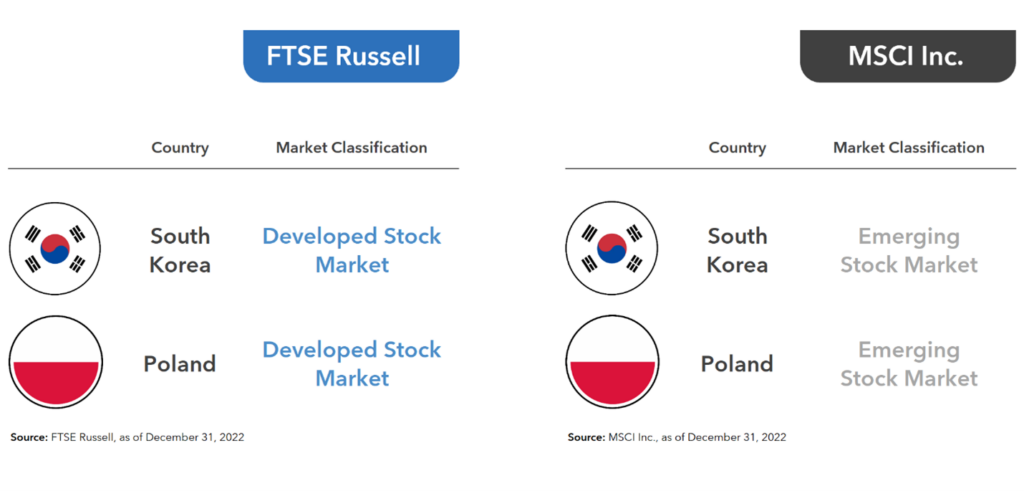

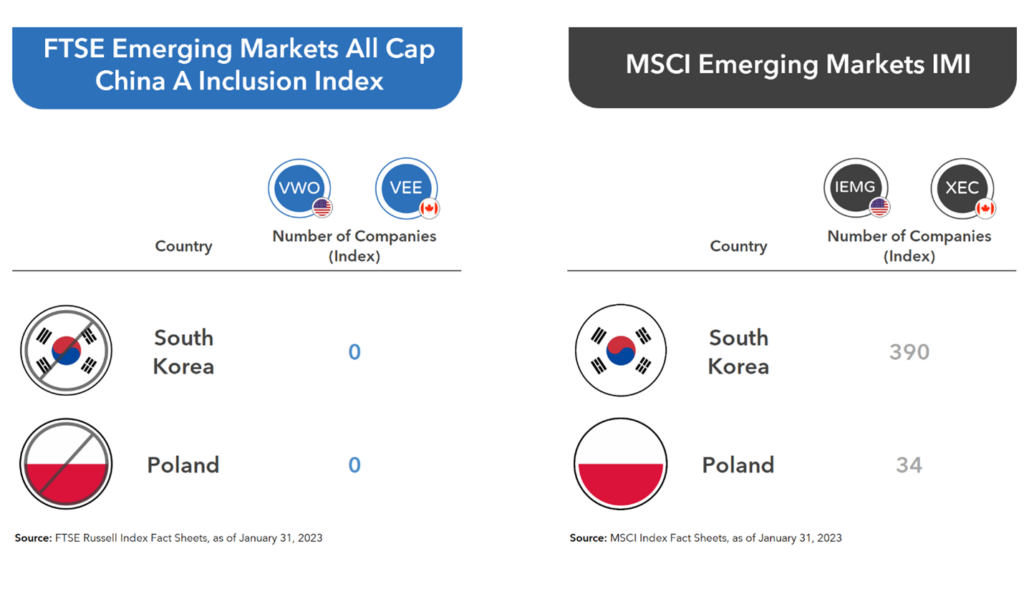

You may also recall from our international equity video that FTSE classifies South Korea and Poland as developed countries, while MSCI classifies them as emerging markets.

This means that IEMG and XEC (which follow an MSCI index) track hundreds of additional South Korean and Polish companies. And VWO and VEE (which both follow a FTSE index) exclude them.

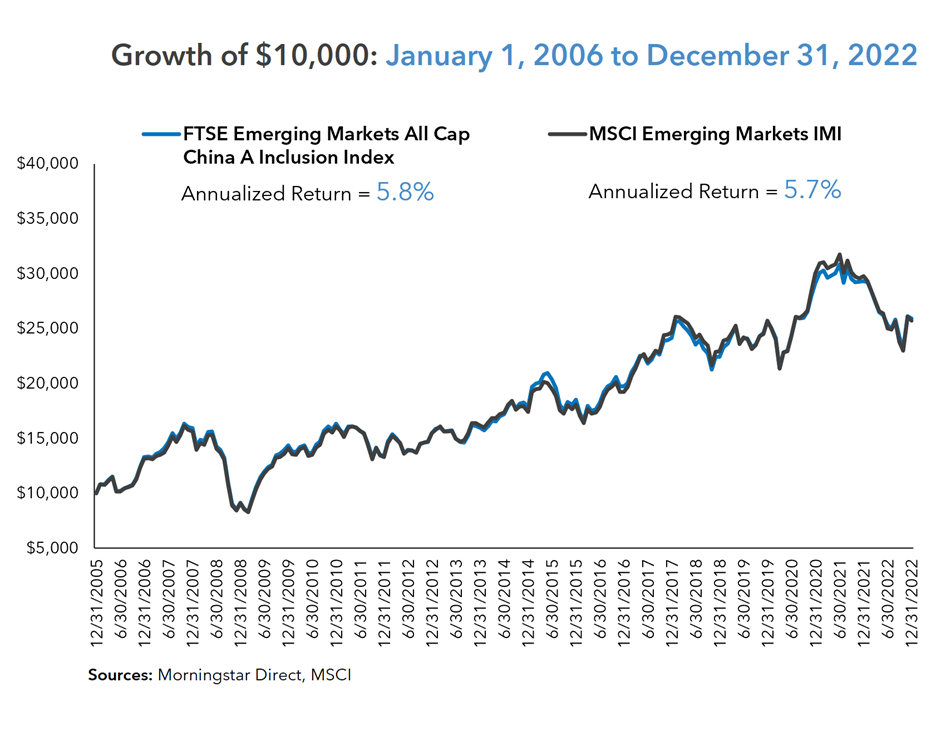

But again, even with their market classification differences, both indexes have experienced similar performance since 2006. The variations are just too puny to matter. Over the long-term, the returns of ETFs following either index are expected to be similar, all else equal.

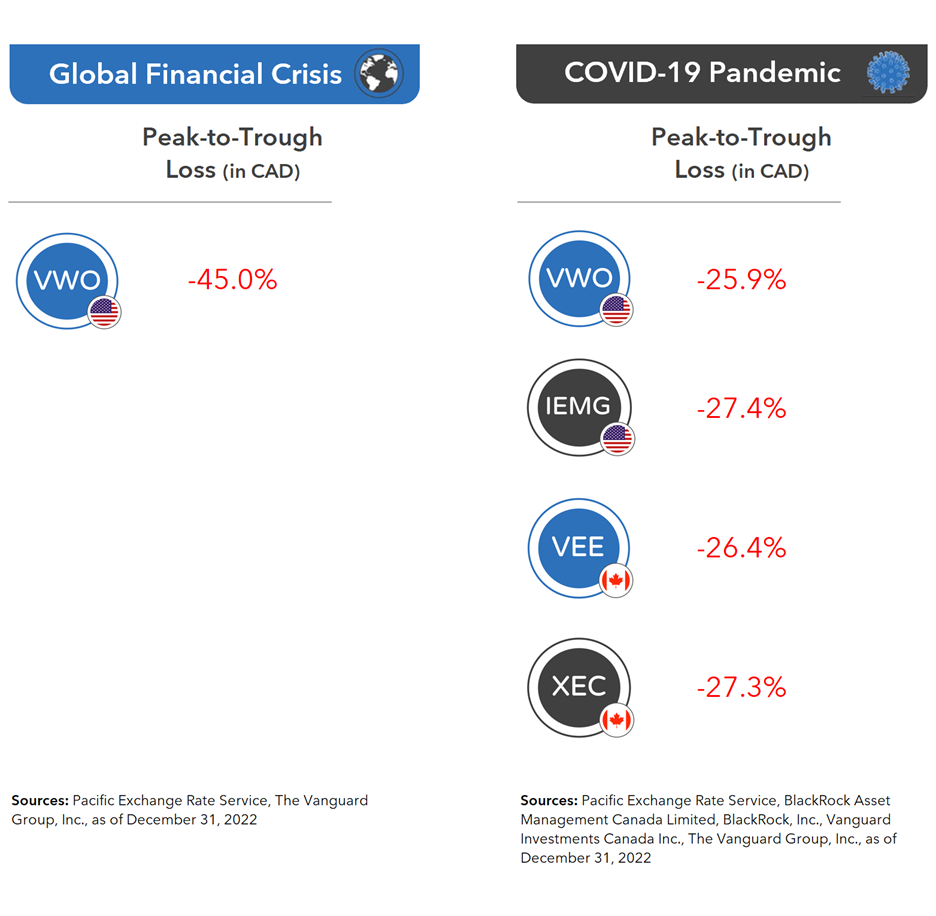

In terms of investment risk, all three ETFs are expected to deliver positive returns over the long-run, but with plenty of bouts of gut-wrenching losses along the way. For example, during the COVID-19 pandemic, each of them lost nearly 30% of their value. And VWO, the only ETF that existed during the Global Financial Crisis, lost almost half of its value during this time, in Canadian dollar terms.

Once again, the point isn’t to even think about panic-selling out of emerging markets during their downturns, but rather, to be prepared to ride out these levels of loss when (not if) they occasionally occur.

In our next blog/video, we’ll review the foreign withholding tax drag on dividends received from these emerging markets equity ETFs. See you then!