With the rise in interest rates over the past year, GICs have sprung back to life in the eyes of many investors. Guaranteed investment certificates, GICs, pay a guaranteed return that is taxable as interest income for taxable investors, and since they are not tradeable assets they do not vary in price. At maturity, the original investment is returned to the investor. Bonds, on the other hand, typically pay a contractual coupon payment which is taxable as income, but their total return is not guaranteed because their price varies over time as market yields change.

The Yield-Price Relationship

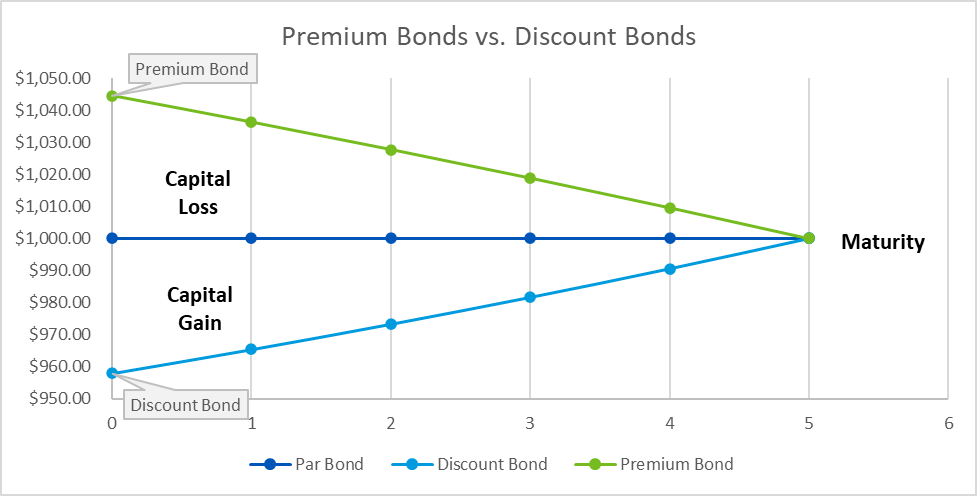

Let’s paint the picture with a hypothetical 5-year $1,000 bond with a 5% annual coupon ($50). If tomorrow yields on comparable bonds increase to 6%, the bond paying a $50 coupon will fall in price such that its coupon and eventual capital gain results in a 6% yield-to-maturity ($957.88 in this case). When a bond’s coupon rate is below its yield-to-maturity we call it a discount bond. Bonds generally mature at par, $1,000 in this example, so the total expected return of this discount bond will consist of coupon payments and a capital gain. If yields instead fall to 4%, we would see bond prices rise – our sample bond would rise to a price of $1,044.52. When a bond’s coupon rate is greater than its yield-to-maturity we call it a premium bond. The expected total return of a premium bond will consist of coupon payments and a capital loss. A bond whose coupon rate and yield-to-maturity match is a par bond.

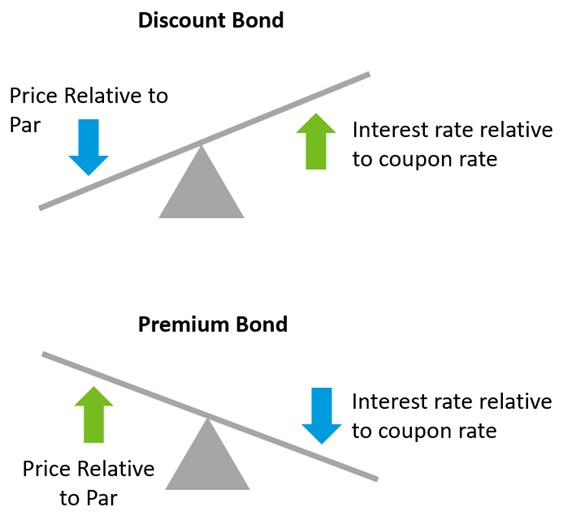

Since a picture is worth a thousand words this relationship can easily be visualized using the childhood playground staple; a teeter totter.

The graph below illustrates how a discount bond will gradually gain value as it approaches maturity and how a premium bond will gradually lose value as it approaches its maturity date holding all other variables constant.

The Past: Premium bonds

When interest rates and bond yields fell sharply after the Great Financial Crisis of 2008, and stayed low for more than a decade after, many bonds became premium bonds, bonds with coupons that exceeded their yield-to-maturity. Premium bonds pose a problem for taxable investors because their total return consists of a relatively high (taxable) coupon payment combined with a capital loss at maturity. Take the previous example where yields fell to 4%. Our bond in this scenario increases in price to $1,044.52, it still pays a $50 coupon, and at maturity there is a $44.52 capital loss. Capital losses cannot be used to offset regular income in Canada, and only 50% of gross losses are deductible against gross capital gain income.

The problem lies in the total after-tax return. Purchasing the premium bond for $1,044.52, receiving $50 annual coupons for 5 years, and incurring a capital loss of $44.52 at maturity equates to a pre-tax yield-to-maturity of 4%. Similarly, purchasing the same dollar amount of a bond trading at par (or a GIC, which is always purchased at par) and receiving $41.78 annual coupons for 5 years equates to a pre-tax yield-to-maturity of 4%. Since interest is fully taxable while capital losses are only 50% deductible in Canada, the after-tax yield-to-maturity on the premium bond will be meaningfully lower. Using after-tax cash flows to calculate the yield-to-maturity, we find that the premium bond in our example has a 0.24% lower post-tax yield-to-maturity than the par bond for an investor at the highest marginal tax rate.

The Present: Discount Bonds

More recently, yields have risen extremely quickly and aggressively, resulting in many discount bonds. In this environment, bonds will tend to be more tax efficient than par bonds or GICs because a significant portion of their return will come from capital gains while GICs continue to pay all of their returns in the form of fully taxable interest. Following the previous examples, we find a similar 0.24% after-tax yield-to-maturity advantage for our discount bond. That is worth something, but our hypothetical example of a gently discounted bond is nowhere near the current reality in the bond market; the impact is in fact far more noticeable.

Looking at the iShares Core Canadian Universe Bond Index ETF, XBB, we see a weighted average coupon of 2.89% with a weighted average yield-to-maturity of 4.24%. With these parameters we find a 1.17% difference in after-tax yield-to-maturity between XBB and an otherwise equivalent bond portfolio at par.

Even if GICs, in some cases, may have higher pre-tax expected returns than bonds, bonds in the current environment have a significant post-tax advantage for a taxable investor. There are of course many other considerations when comparing bonds to GICs like portfolio duration, risk premium exposure, liquidity, and price volatility. We will save these for a future post.