The prospect of a trade war with the U.S. continues to loom, leaving Canadians understandably uneasy. Constantly shifting trade policies and the threat of new tariffs are fueling market volatility, leaving many uncertain about how these changes could impact markets and their savings.

For those who remember the classic 80s movie Ferris Bueller’s Day Off, there’s a scene where the economics teacher, played by Ben Stein, drones on about the Smoot-Hawley Tariff Act of 1930. While intended to be a funny scene, the lesson is real.

Tariffs in 1930 were enacted with the hope of boosting the U.S. economy. Instead, global trade collapsed and the Great Depression worsened. While we don’t yet know the impact of these tariffs on markets or economies – or even how long they will last – we can provide you with some critical context for weathering the storm.

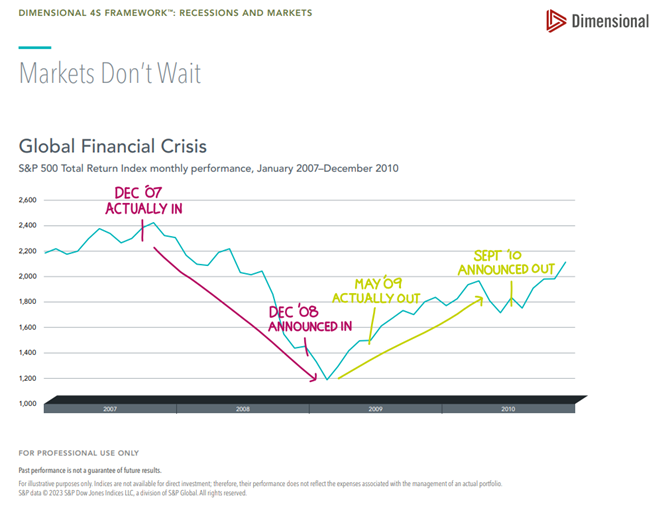

Many of you may be understandably concerned about whether the new tariffs could tip the economy into recession. While a recession is possible, it’s important to remember that recessions and stock markets are not the same thing.

By the time we know we’re in a recession, it’s too late to make investment decisions. As the following two charts show, using economic data to make portfolio decisions has historically turned out poorly for investors.

(source: Dimensional https://my.dimensional.com/collections/4s/recessions-and-markets)

Tariffs are not new, and neither is geopolitical uncertainty. We are seeing concerns about broader trade restrictions, regulatory changes, and potential constraints on Canadian banks operating in the U.S.

But amid the doom and gloom of recent headlines, many investors likely didn’t realize that many developed international stock markets are soaring, with German, French, and UK stock markets up more than 10% year to date (in CAD).

MSCI Total Return Indexes as of March 17, 2025

| MSCI Index | YTD Return CAD |

|---|---|

| Canada | 0.64% |

| USA | -3.94% |

| France | 14.87% |

| Germany | 21.38% |

| UK | 10.73% |

| Japan | 3.08% |

| China | 20.40% |

(source: MSCI)

At PWL, we’ve always advocated for international diversification. Stock markets around the world don’t always move in tandem, and this year has, so far, been a great example. For this reason, the equity portion of most of our client portfolios will contain an allocation to international stocks.

Additionally, currency movements can act as a buffer. For example, the Canadian dollar has weakened relative to the U.S. dollar on tariff expectations, and foreign holdings benefit when our domestic currency declines, helping offset some of the impact.

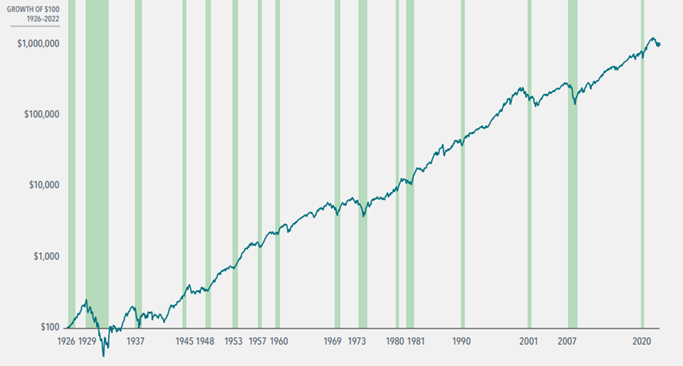

History has shown that markets can endure incredible volatility—dot-com bubbles, financial crises, pandemics—yet investors who remained disciplined saw their portfolios recover and grow.

The chart below shows the growth of $100 invested in the US stock market in 1926. Shaded areas depict recessions.

(source: Dimensional: https://my.dimensional.com/market-returns-through-a-century-of-recessions)

Despite volatility, through 16 recessions, markets have shown incredible growth and resiliency. While we can’t say for sure what the future holds, history is encouraging for long-term investors.

Your financial plan is built to weather market uncertainty. If your goals haven’t changed, neither should your strategy.

While this should be no surprise to you, we do not engage in market timing or tactical trading based on short-term events. Our portfolios are globally diversified, which helps mitigate risks associated with any single country’s trade policy. While tariffs create short-term challenges, they do not change the fundamental principles of disciplined, long-term investing.

History has shown that reacting emotionally to market events can do more harm than good. The best strategy is remaining invested and focused on your long-term financial goals.