In a recent blog we discussed how a fall in market prices today leads to an expectation of higher returns tomorrow. We explore this in more detail by considering the impact of the fall in portfolio values at the end of March and the revised expected returns on investors in different stage of their lives.

We start with a simple model and then look at some real-life examples. For our model we consider the five different investors as shown in the table below.

| Investor | Age (years) | Initial Portfolio ($’000) | Annual savings ($’000) | Savings Period | Withdrawal Period |

| Alice | 35 | 500 | 20 | 30 | 30 |

| Bob | 45 | 500 | 20 | 20 | 30 |

| Claire | 55 | 500 | 20 | 10 | 30 |

| Daniel | 65 | 500 | 0 | 0 | 30 |

| Erica | 75 | 500 | 0 | 0 | 20 |

We assume each investor retires (or has retired) at age 65. Bob, for example, is age 45, has $500,000 in savings and is saving $20,000 annually for 20 years, whereupon he will withdraw from his portfolio for 30 years. Erica is age 75 and has $500,000 in her portfolio and expects to withdraw for 20 years.

We consider the impact of a “shock” to their portfolios on a par with recent market declines. To be specific, we use the performance of a diversified 60% stock, 40% bond portfolio as represented by the Vanguard Balanced ETF Portfolio (VBAL) which declined 10.44% in the first three months of 2020.

PWL calculates expected returns and expected inflation, based on historic and current valuations.

| Before Coronavirus

Dec-2019 |

After Coronavirus

Mar-2020 |

|

| Expected Return for a 60% stock, 40% bond portfolio | 4.99% | 5.14% |

| Expected Inflation | 1.60% | 1.50% |

In each case, we assume that our investors withdraw a constant amount so that their investments are reduced to zero at age 95. Alice, who has $500,000 at age 35, and plans to save for another 30 years, will have a higher retirement income than Daniel who has the same portfolio value but is immediately starting to withdraw for retirement. We are interested in the combined impact of the decrease in our investor’s portfolio value and the increase in expected returns and we will measure this by computing the change in the retirement income of each investor.

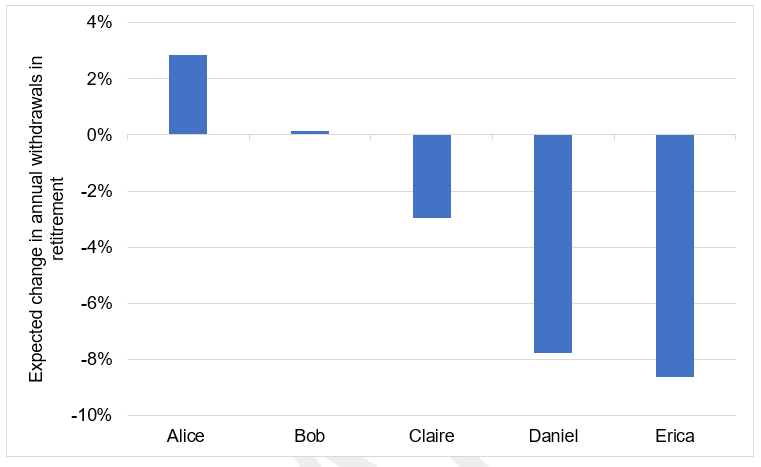

Details of the calculations can be obtained from the authors. The changes in annual retirement withdrawals for each investor are shown in the chart below.

Source: PWL Capital

Alice can expect an increase in retirement income because the decrease in her savings is more than compensated by the higher future returns over 30 years of future savings and an additional 30 years of retirement. Erica, in contrast, has a much shorter investment period and a significant proportion of the decline in her portfolio value is reflected in a decline in future income. Claire is between these two extremes and only sees a modest fall in in income as she still has 10 years of savings, and a 40-year investment horizon ahead of her.

This is a simple model; individual experiences will vary and should be addressed through a detailed retirement plan. We are assuming no fees, no taxes, a constant asset allocation and constant, inflation indexed savings and consumption. In particular, the portfolio decline is certain (it has already happened) but the increased expected returns are in the future and subject to uncertainty of both their value and their persistence.

None of our clients fit perfectly into this simple model. For those with substantial assets, especially as younger investors, early retirement is often desired which leads to longer retirement horizons. In addition, most clients don’t solely rely on investment assets in retirement; most will receive CPP and OAS throughout retirement and some investors have access to defined benefit pensions or other retirement income. We looked at a variety of detailed financial plans to determine the realistic impact of recent portfolio declines on clients’ ability to generate retirement income. These plans incorporate uncertainty related to future expected returns and the impacts of potential future market declines in investment portfolios with respect to retirement income.

For younger investors with 20 – 25 years to retirement and a withdrawal period of 40 years, we see that even with larger drops in their portfolio due to holding riskier assets, they can still maintain the same level of retirement spending pre- and post-COVID-19. This is consistent with Bob’s example above. If those clients decided to delay their retirement, we would expect an increase in spending ability similar to Alice.

For those just about to enter into retirement, like Daniel, the impact of recent market declines is less punitive than the 8% decline in retirement income shown above. Additional income like CPP and OAS, and the fact that those in retirement often have less risky assets than those earlier on in their investing journey dampen the impact on projected retirement consumption. In our own client examples, for clients early in retirement or within 1 year of retirement, declines in expected after-tax income ranges from 2% to 6%. Finally, an example of an older couple with fewer years to benefit from increased expected returns, the decline in retirement spending is less than 4%, given the dampening effect of government pensions on the decline in their expected retirement consumption.

The simple simulation above shows that impacts to estimated retirement incomes are much less than the decline in client portfolio values. The real-life examples show that it’s often an even better news story when we incorporate the net impact of other factors (taxes, fees, government pensions, differing asset allocations) into the financial picture.

Having a tailored financial plan can help quantify the long-term impacts of portfolio fluctuations on future income estimates and help investors make decisions given their current situation. Alice, for example, may contemplate her good fortune at being able to invest in stocks at a reduced price but she may also consider whether there is level of retirement income, once achieved, that should be secured by reducing her stock exposure and reducing the impact of future shocks. This type of goal based investing is explored in more detail here.