In wealth management M&A, the Letter of Intent (LOI) is a critical milestone. Before an LOI is signed, there are usually many conversations to confirm cultural and strategic fit. Once both the buyer and seller are aligned and ready to move forward an LOI is signed. This is the point where a concept turns into a formal deal framework but before a final purchase agreement is drafted.

An LOI is a non-binding agreement that outlines the intent to work toward a deal without obligating either party to finalize a deal. The LOI provides an overview of how the transaction will be structured and a target close date. While most of the agreement is non-binding, there are binding components, most notably a commitment of exclusivity. For a defined period, both parties agree to negotiate only with each other. This gives the buyer confidence to invest time and resources in due diligence without competing bids and gives the seller comfort that the buyer is serious.

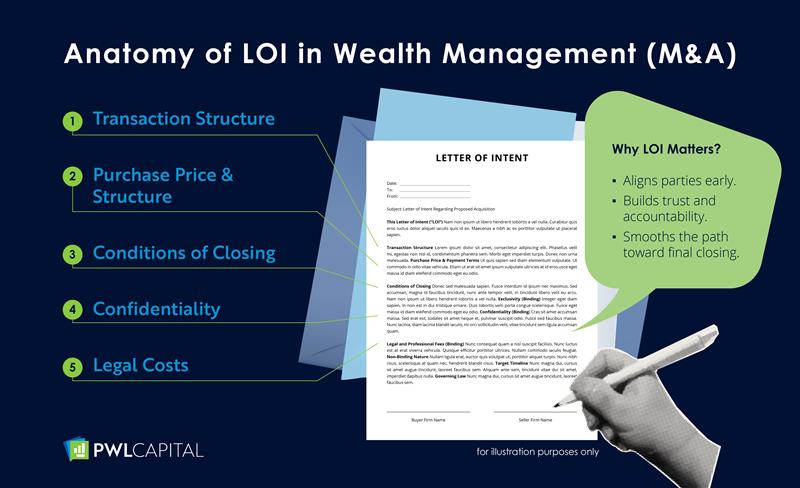

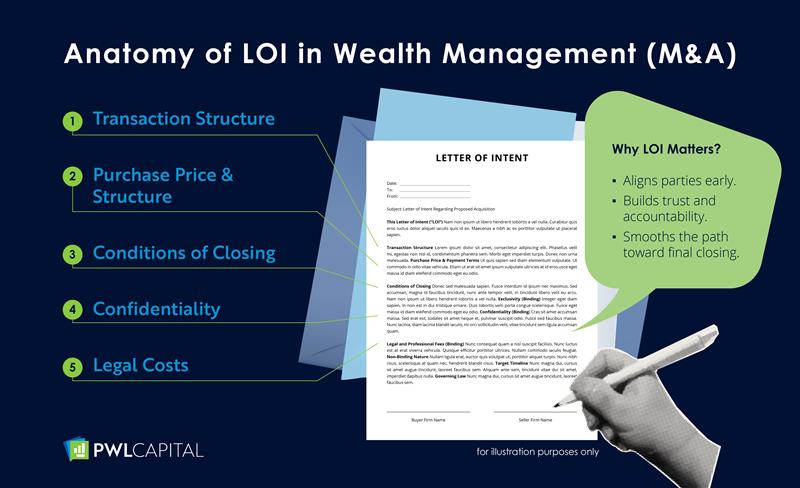

While every LOI is unique, most contain a common set of terms that set the tone for negotiations and define how both sides will proceed. Here’s a breakdown of the main components:

1. Transaction Structure: Asset Purchase vs. Share Purchase

The LOI outlines how the overall transaction will be structured. In most cases, a deal is structured as either an asset purchase deal or a share purchase. The main difference being:

- In the case of an asset purchase, the buyer acquires specific assets and assumes selected liabilities. In most wealth management transactions, the asset would be the client list, goodwill, intellectual property and all associated revenues. This is usually the simplest and cleanest way to structure a deal. From the buyer’s perspective, this gives them more control over what they buy without taking on any unnecessary liabilities.

- With a share purchase, the buyer acquires the entire corporate entity, including all past, present and future liabilities including unknown ones that could arise from tax audits, legal disputes or compliance issues. To mitigate risk, the buyer will typically require a robust list of representations, warranties and indemnities to be included in the final agreement. More complicated, yes, but selling the shares of a qualified small business corporation can be advantageous for the seller provided they meet the requirements for the lifetime capital gains exemption (LCGE).

2. Purchase Price and Structure

An LOI typically provides a headline purchase price or formula for the deal which is expressed as a multiple of revenue or EBITDA. It will also outline how the total proceeds will be paid to the seller. Some of the considerations will include:

- Proceeds payable at close vs. deferred payments: In most cases, the bulk of the proceeds will be paid up front. This is usually somewhere between 50 to 80%. The remaining balance is then paid after a defined period (e.g. 12 months after close) provided certain conditions are met. The deferred payment can be a measure of revenue retention, organic growth rate, EBITDA, or some combination of these. The LOI will sometimes include an appendix detailing the factors required to receive some or all the deferred payment amount.

- Cash vs. Equity: In many cases the acquiring firm will provide the seller with equity as a portion of the total deal proceeds. There is a benefit for both the buyer and seller to have equity form part of the total proceeds. The seller gets the opportunity to participate in future growth of their new firm. Providing equity means less cash to pay out for the buyer and shows that the seller has “skin in the game” and wants to help grow the company after joining.

- Revenue or EBITDA Multiple: The total proceeds are calculated by using a multiple of revenue or EBITDA. This multiple will typically be used to determine the final amount owing at closing.

The purchase price included in the deal is the best estimate of total proceeds based on the initial pro forma financial analysis. Through the due diligence period, the final amount will be updated using more recent financials and after factoring in all relevant expense and revenue adjustments.

3. Conditions of Closing

The LOI will list key items that must be satisfied before the deal can close, such as:

- The seller confirms that they have exclusive solicitation rights for the client list that is being considered in the transaction.

- After close there may be a requirement for team members to enter signed employment agreements.

- Seller will be required to provide detailed financial statements for the past three to five years.

- Full disclosure of all material contracts, liabilities, and obligations.

- Details of regulatory approvals, where applicable.

4. Confidentiality

LOIs typically reaffirm confidentiality obligations already in place, often from a prior non-disclosure agreement (NDA). Both sides agree to keep deal terms, negotiations, and sensitive business information private regardless of the outcome.

5. Legal Costs

Each party is responsible for its own legal costs. This ensures neither side is burdened with the other’s professional fees if the deal does not proceed.

While the LOI is not the final agreement, it is more than just a “letter of good intentions.” It sets the blueprint for the deal, frames the key points, and creates the conditions under which both sides will work toward a successful close. A well-drafted LOI reduces surprises later.