Occasional market crashes are part of investing. Stock prices reflect investors’ expectations about the future earnings and risk of the companies they invest in. When expectations or risk change due to something like nonsensical sweeping tariffs, stock prices can change quickly and dramatically.

Falling stock prices do not mean the market is broken or that the world is ending. They are expected from time to time, and their inevitability should be built into every investment plan.

Stock market declines happen frequently and should be part of your expectations when you start investing.

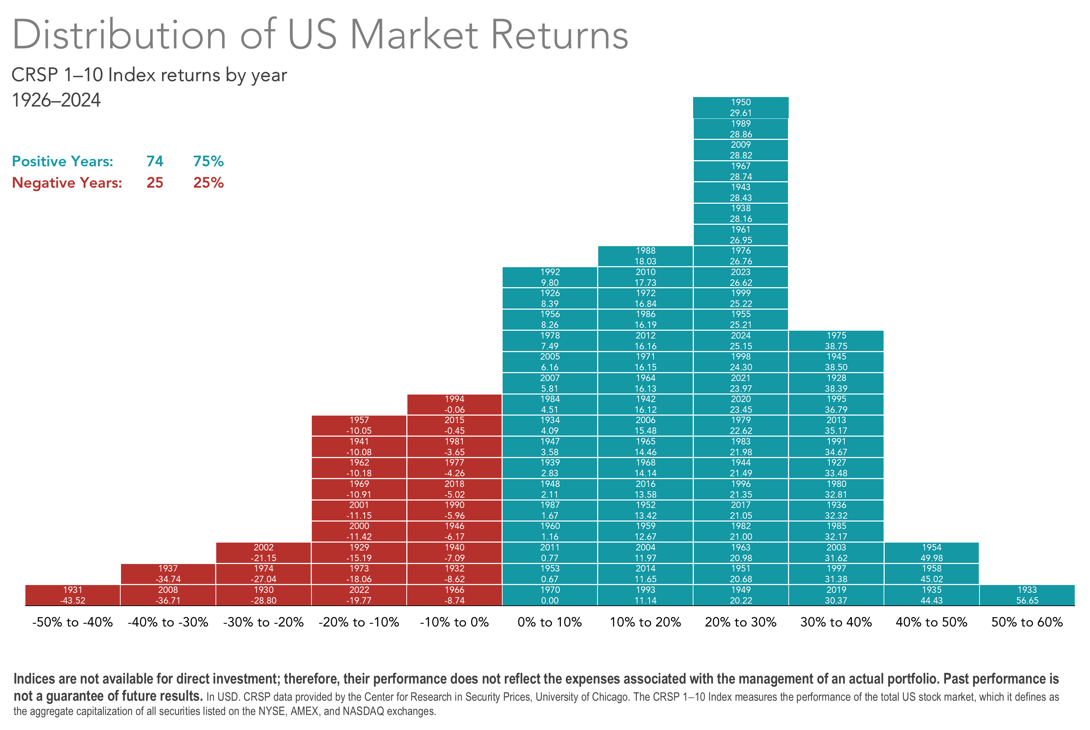

Looking at annual data for U.S. stocks going back to 1926, stock returns are negative in about 25% of years.

Source: Dimensional Fund Advisors

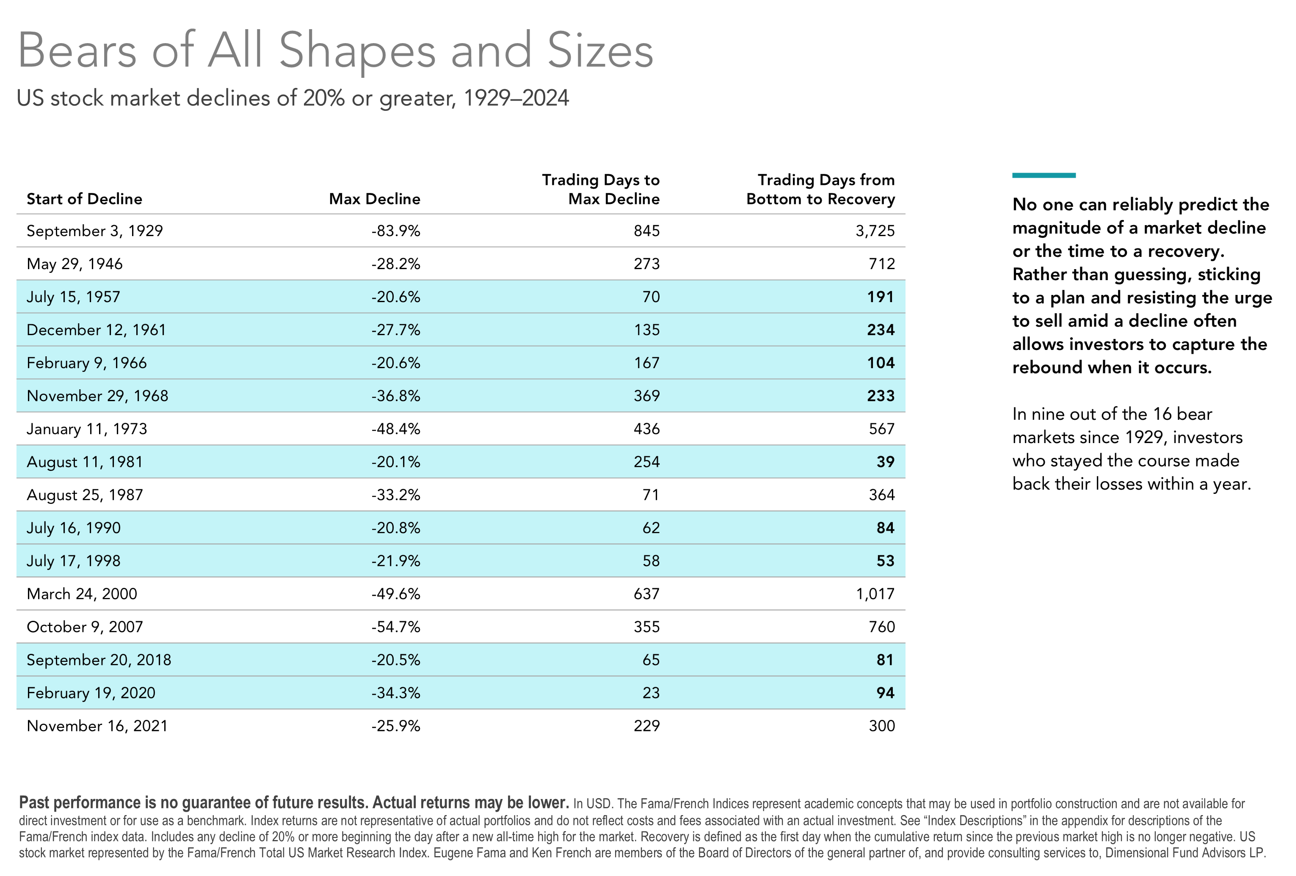

Declines of 20% or more happen less frequently but are not uncommon. When crashes do happen, they typically recover — at least eventually.

Source: Dimensional Fund Advisors

Your asset allocation should be informed by your financial plan. Negative intrayear returns don’t always predict negative annual returns. It’s not uncommon for stocks to dip into negative territory during the year while finishing the year with positive returns.

Most investors understand that market crashes can and will happen. But like stepping in the ring with Mike Tyson in his prime, everyone has a plan until they get punched in the mouth. It’s one thing to look at historical data and see recoveries on a chart, but another thing entirely to live through one.

Every market drop feels different and the recovery never feels obvious. There’s always a narrative surrounding the crash, and the narrative is scarier than the relatively abstract drop in stock prices itself. Narratives are not a sideshow; they are a fundamental part of every market crash.

Economic data are boring and slow-moving. But the beginning of the end of the world due to (insert crisis here) moves asset prices.

To get through market crashes, investors need to understand:

As far back as we have data, the optimists — those who have invested in stocks — have typically triumphed. Global stock returns have been meaningfully positive for at least 125 years, delivering a little more than an annualized 5% real return (adjusted for inflation in USD from 1900 through 2024).

Stock markets have always been volatile and risky. It should be expected that there will be years or clusters of years with negative returns. That’s completely normal. It would be weird not to have down years.

Stocks have positive expected returns because they are risky. That long-term performance is called a risk premium, and it’s not always fun to earn it.

Still, investors who thought they were comfortable with all-equity portfolios a month ago might be ready to abandon ship today. Narratives likely explain why.

In his 2017 paper Narrative Economics, Nobel laureate Robert Shiller explains:

“Narratives are human constructs that are mixtures of fact and emotion and human interest and other extraneous details that form an impression on the human mind.”

Narratives can change how we interpret facts and cause us to ignore base rate probabilities while drawing parallels to familiar past stories. The narrative does not change the facts, but it does change how people respond to them.

Take the 1920-21 U.S. recession. World War I had just ended, the 1918 flu pandemic lingered, there were race riots, and a growing fear of communism. The resulting narrative was one of deep economic uncertainty.

Or consider the COVID-19 pandemic. It shut down the global economy and made people question whether things would ever return to normal. Yet here we are.

Today we are living through a global trade war. Most economists agree tariffs are bad for the economy, and the market seems to agree. Tariffs reduce expected earnings and increase uncertainty.

Every time feels different. And every time is different in its own way. That’s why crashes happen.

Global financial markets have seen periods of globalization followed by contraction before. In the early 1900s, there were active stock and bond exchanges in over 40 countries. But with World War I, global finance contracted, protectionism rose, and some markets closed temporarily or permanently.

Will it get that bad again? I don’t know. But despite those losses, global markets have proven resilient, delivering positive real long-term returns.

Crashes and recoveries are as old as financial markets themselves. A 2017 paper, Negative Bubbles: What Happens After a Crash, studied 1,032 events from 1692 to 2015 where a market dropped by more than 50% in a year. These large declines were typically followed by positive returns.

That data set is immune to narrative. Every one of those crashes probably came with scary stories, just like today. But we now have the benefit of stepping back and looking at outcomes.

When stock prices decline, expected returns go up. For long-term investors, this can offset much of the price drop’s impact. If you’re still contributing to your portfolio, this could even be good news.

But investor sentiment tends to turn pessimistic during crashes, even when long-term prospects improve. Another example of narrative overriding base rates.

None of this means you should do nothing. Crashes are rare opportunities to learn about your own risk tolerance. Ask yourself:

If this feels worse than expected, your portfolio might be too aggressive. If you’re in a conservative portfolio and feel fine, you might be able to take on more risk.

Revisit your financial plan. It should be built to withstand volatility. But if something needs to change, it’s better to find out now.

Market crashes are objectively not fun. Narratives shape how we interpret them. Rather than focusing on the unique specifics of each crisis, step back and look at the broad historical data we have.

You should be invested in an asset allocation you can stick with in both good times and bad. Getting out when things get rough is one of the best ways to sabotage your returns.

If a market drop has been too painful, maybe you were taking on too much risk. I’m not saying everything will be okay by next week. The market might keep falling. It may seem like staying invested was a mistake.

But timing your reentry is harder than it sounds, and getting it wrong can be costly.

Yes, the economy might take a hit. That’s why you have an emergency fund. Yes, stocks might keep dropping. That’s why you invest in a risk-appropriate portfolio.

When things feel uncertain, long-term decision-making gets harder. That’s why you made a plan in calmer times. Now is the most important time to stick to it.